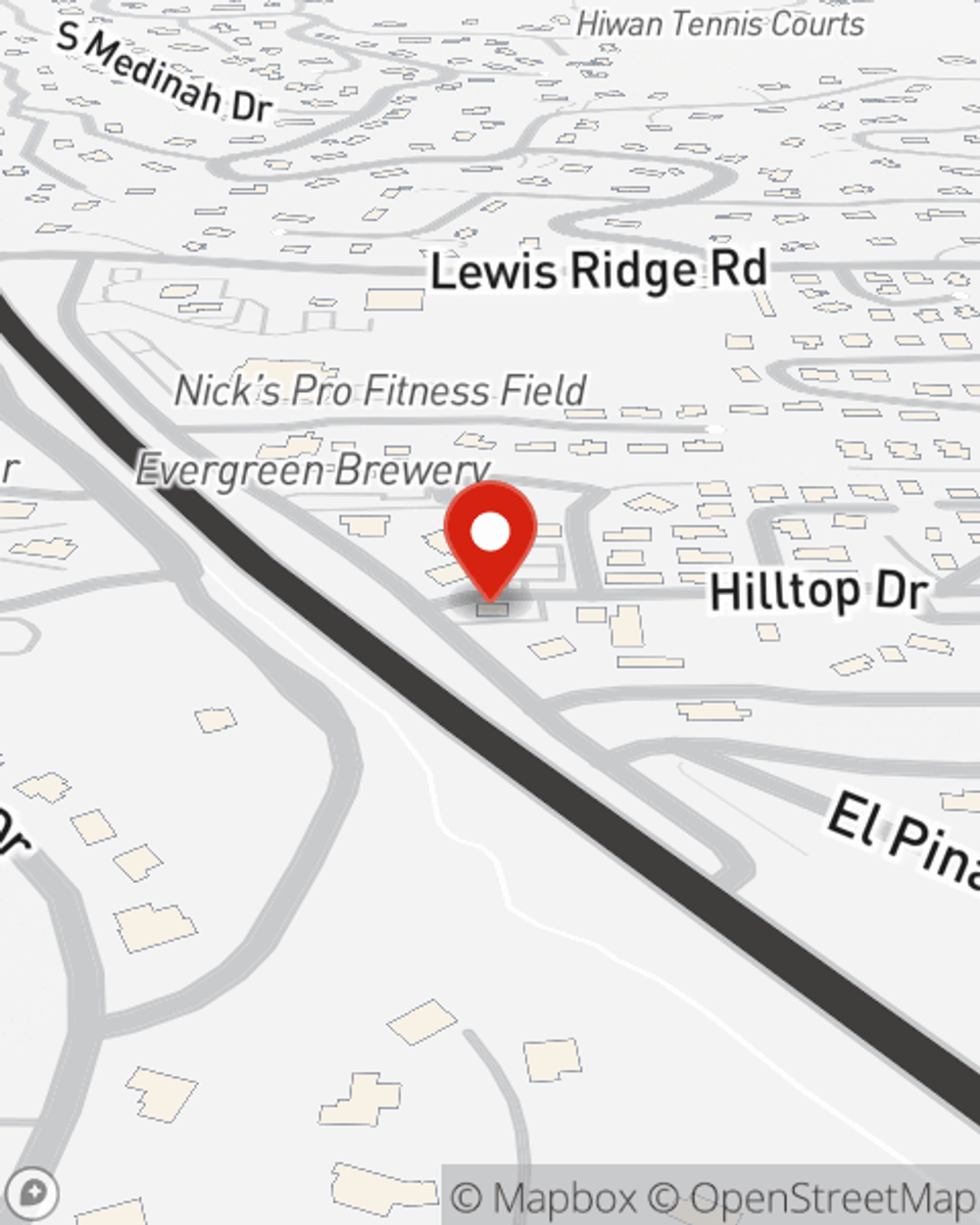

Homeowners Insurance in and around Evergreen

Looking for homeowners insurance in Evergreen?

Help cover your home

Would you like to create a personalized homeowners quote?

- Evergreen

- Conifer

- Idaho Springs

- Genesee

- Pine

- Golden

- Indian Hills

- Kittredge

- Bailey

- Jefferson County

- Clear Creek County

- Littleton

- Englewood

- Boulder

- Douglas County

- Lakewood

- Wheat Ridge

- Morrison

- Arvada

Insure Your Home With State Farm's Homeowners Insurance

Your house isn't a home unless your protected with State Farm. This excellent, secure homeowners insurance will help you protect what you value most.

Looking for homeowners insurance in Evergreen?

Help cover your home

State Farm Can Cover Your Home, Too

State Farm's homeowners insurance guards your home and your possessions. Agent Michele Vanags is here to help set you up with a plan with your specific needs in mind.

More homeowners choose State Farm® as their home insurance company over any other insurer. Evergreen homeowners, are you ready to see what the State Farm brand can do for you? Visit State Farm Agent Michele Vanags today.

Have More Questions About Homeowners Insurance?

Call Michele at (303) 674-6629 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Maintaining a historic home

Maintaining a historic home

With a historic home, completing these home maintenance tasks a little bit at a time could improve the overall resale value of your home.

Home warranties

Home warranties

Learn here about what home warranties are, what they cover, and how they might offer added protection.

Michele Vanags

State Farm® Insurance AgentSimple Insights®

Maintaining a historic home

Maintaining a historic home

With a historic home, completing these home maintenance tasks a little bit at a time could improve the overall resale value of your home.

Home warranties

Home warranties

Learn here about what home warranties are, what they cover, and how they might offer added protection.